Sara’s Weekly Update #20

Welcome to my newsletter! I write down my thoughts & opinions on the topics I read/watch in the last week. My topics of interest are wide, please feel free to skip to the topic you like.

Joe Biden and Narendra Modi are drawing their countries closer

To work, the relationship will have to function like a long-term business partnership: India and America may not like everything about it, but think of the huge upside. It may be the most important transaction of the 21st century.

Modi visited Biden here in the US & the partnership looks positive. India might see a huge growth in the coming decade. It's a difficult partnership of course as India has ties with Russia and it has to balance the relationship between these countries. So far it feels like it's managing it better, hope it stays that way.

Fed chair expects more rate hikes amid inflation fight

Inflation is moderated still it's not coming down as expected. FMOC participants think we need more rate hikes before this year ends. Labor market is tight, so they are comfortable to raise rates further to fight inflation.

Personal Finance

Lately I have been thinking about creating a portfolio which

is simple enough for anyone to understand

managed passively

pays dividends

allows me to sleep well

Why do I need a simple enough portfolio?

I don’t want to over complicate it as anyone should be able to understand it if I am not around & make it easy for everyone around me. Also I don’t have to spend time making investment decisions, it frees up my mind for other activities.

Why do I need a passively managed fund?

Management fee is less

Humans are emotional and make erratic decisions. Whereas computers are not emotional and keep executing the simple strategy again & again & in the long run it gets better return too. Below talk explains why indexing beats active management. I read his book What Works on Wall Street & The Little Book of Common Sense Investing. I am totally convinced indexing is best for me.

Why Dividends are Important?

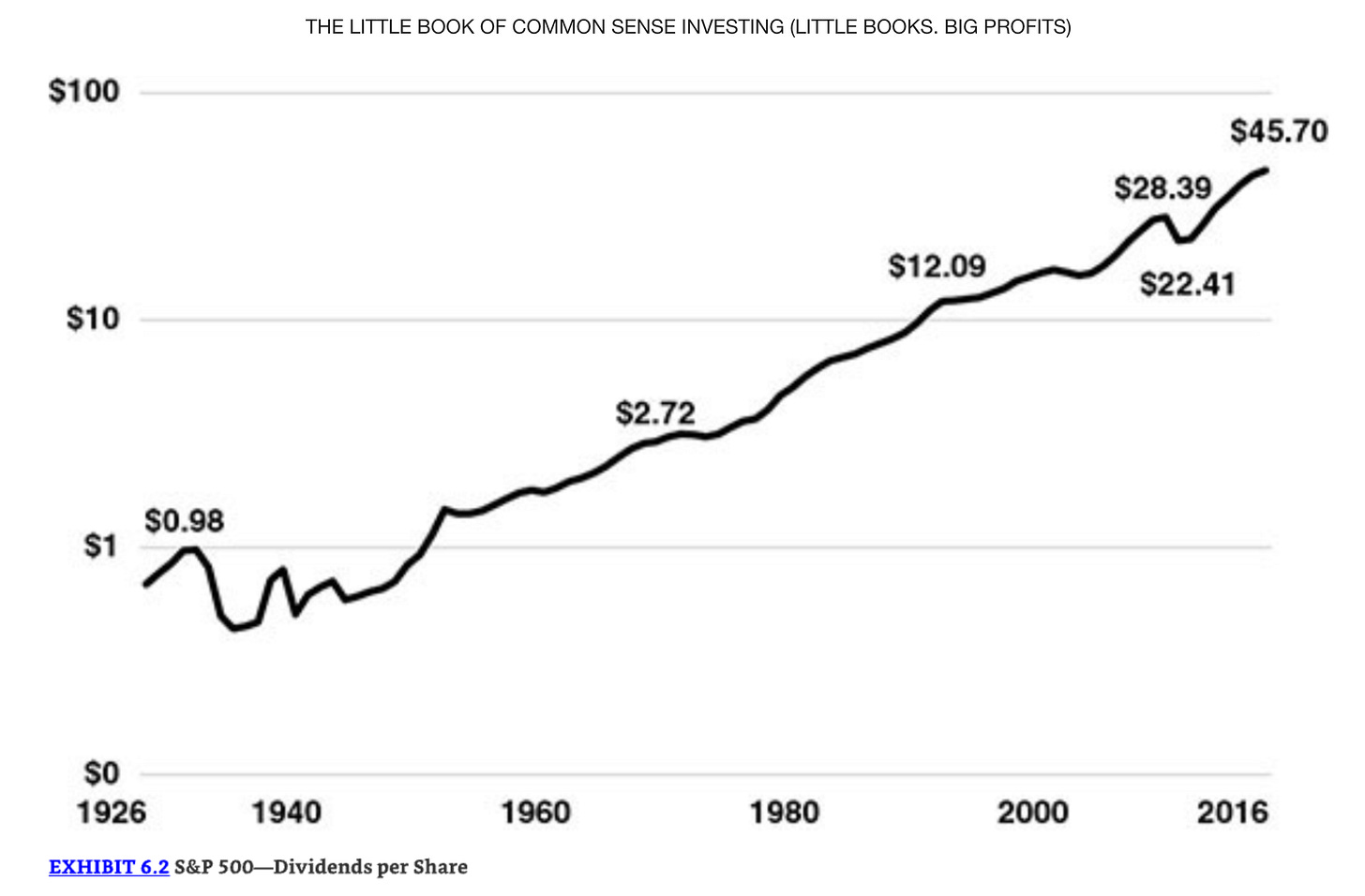

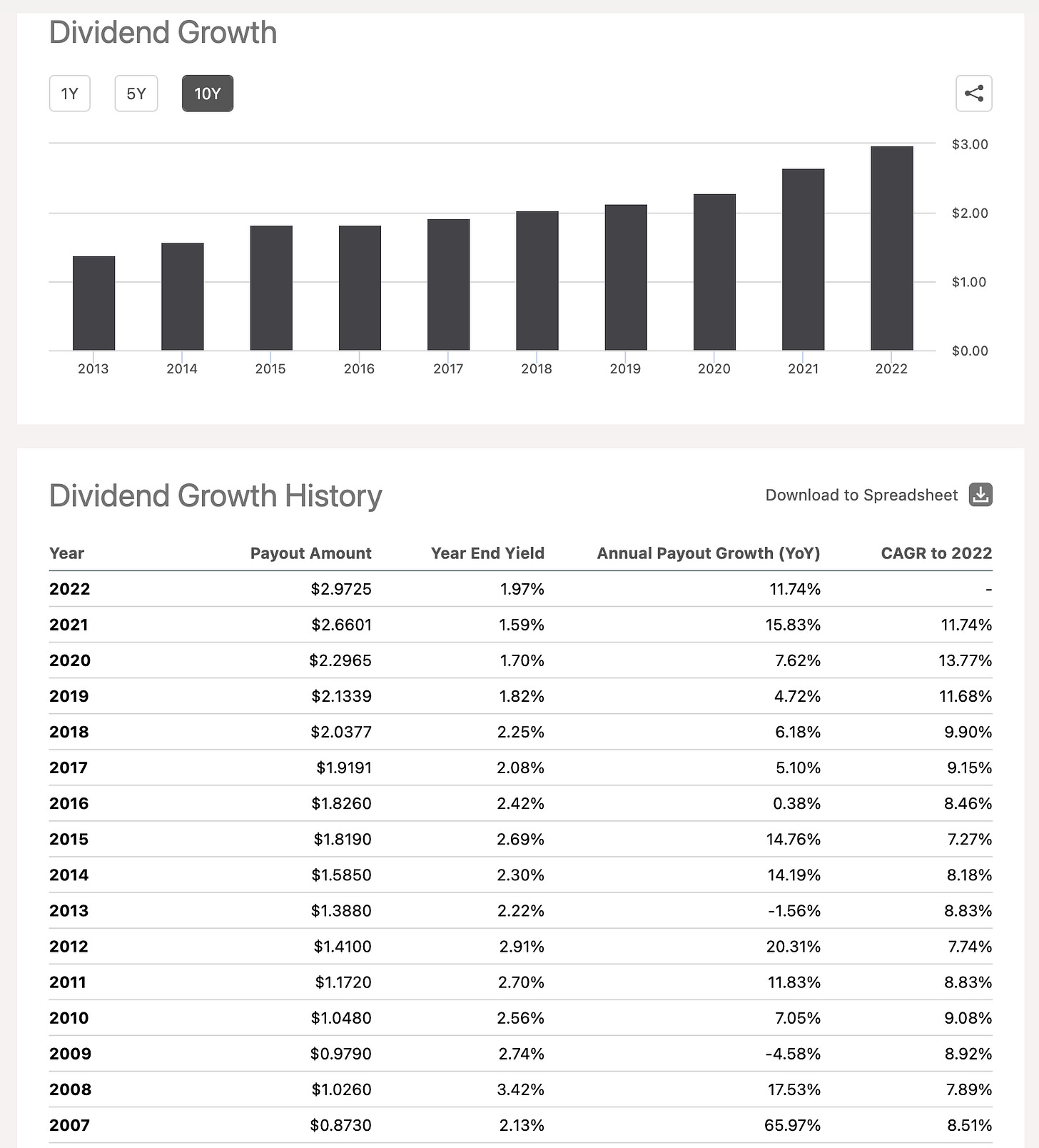

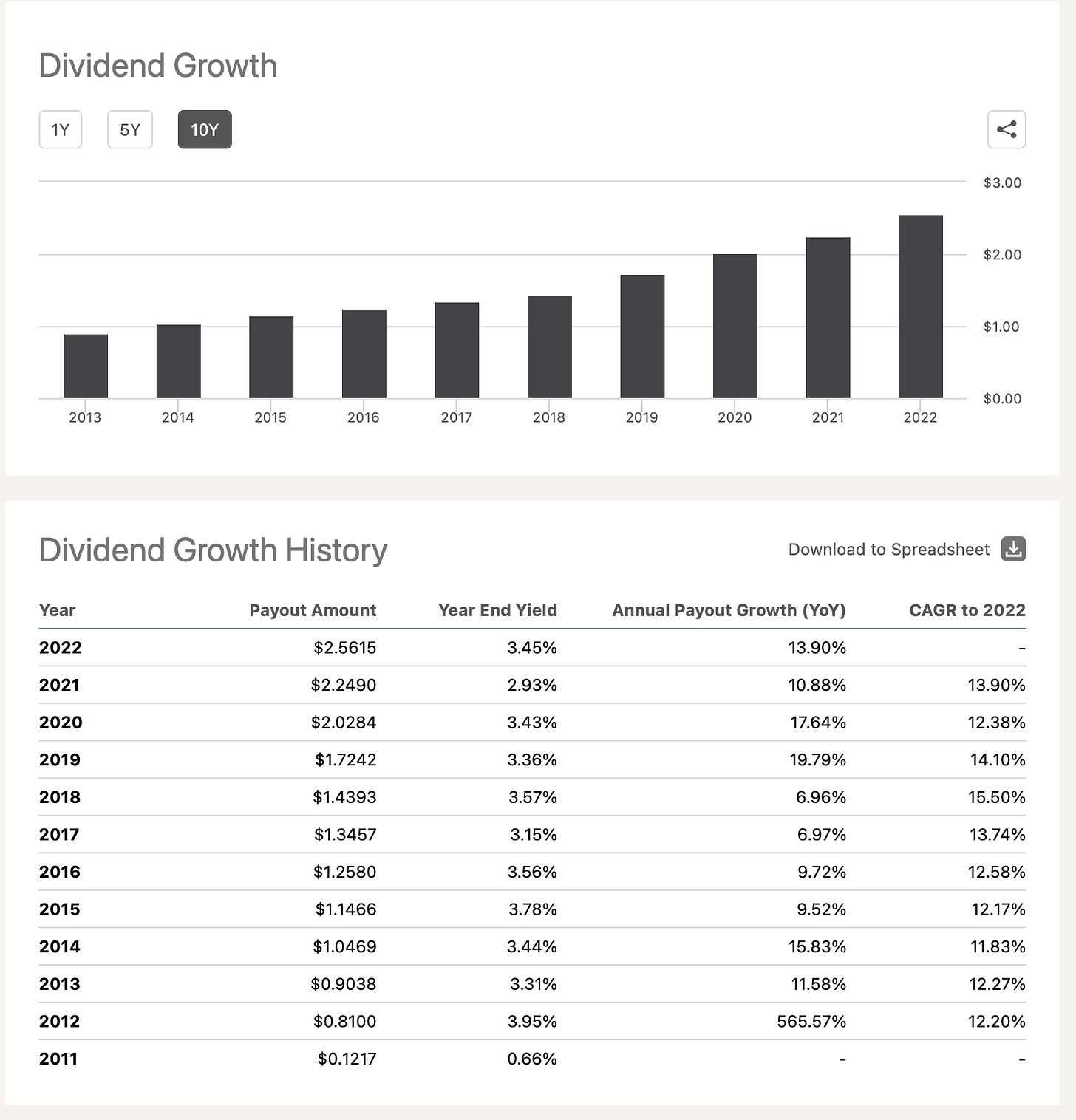

Dividends fluctuate very less compared to the actual stock. As per Jack Bogel we can learn to live with the dividends in retirement rather than worrying about the fluctuating stock price. Below graph shows dividend cuts happened only during major economic crises. Btw, VIG dividends are increased in 2020, 2021 & 2022 where as the VIG stock price fluctuated a lot during the same period.

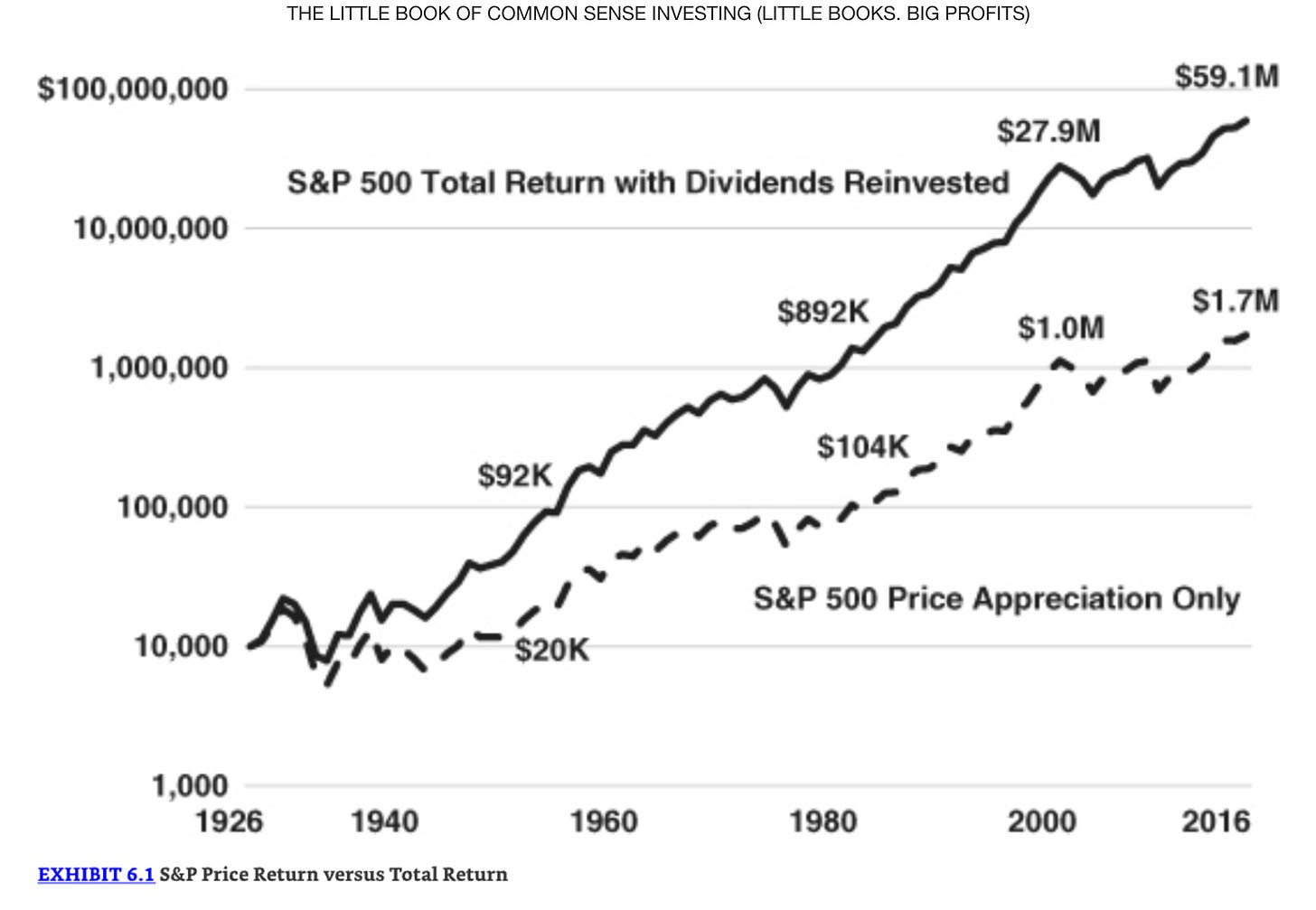

Dividends reinvested, provide a much greater return in the long run. Lately most of the companies do buy back shares that also is a dividend paid to shareholders indirectly.

Also companies which consistently grow the dividends is a proxy to the companies earnings growth. Without earnings growing, companies cannot keep increasing the dividends.

Why I need a portfolio which allows me to sleep well?

I am planning to invest a major part of my assets in this portfolio, and planning to live off the dividends from this portfolio in the coming decades. I don’t want to take unnecessary risk in this & lose my sleep over it. I am okay to give up some growth for less stress.

Portfolio Construction

Now I am convinced to look for a Dividend growth ETF due to the above reasons. I looked into top 3 Dividend ETFs based on AUM.

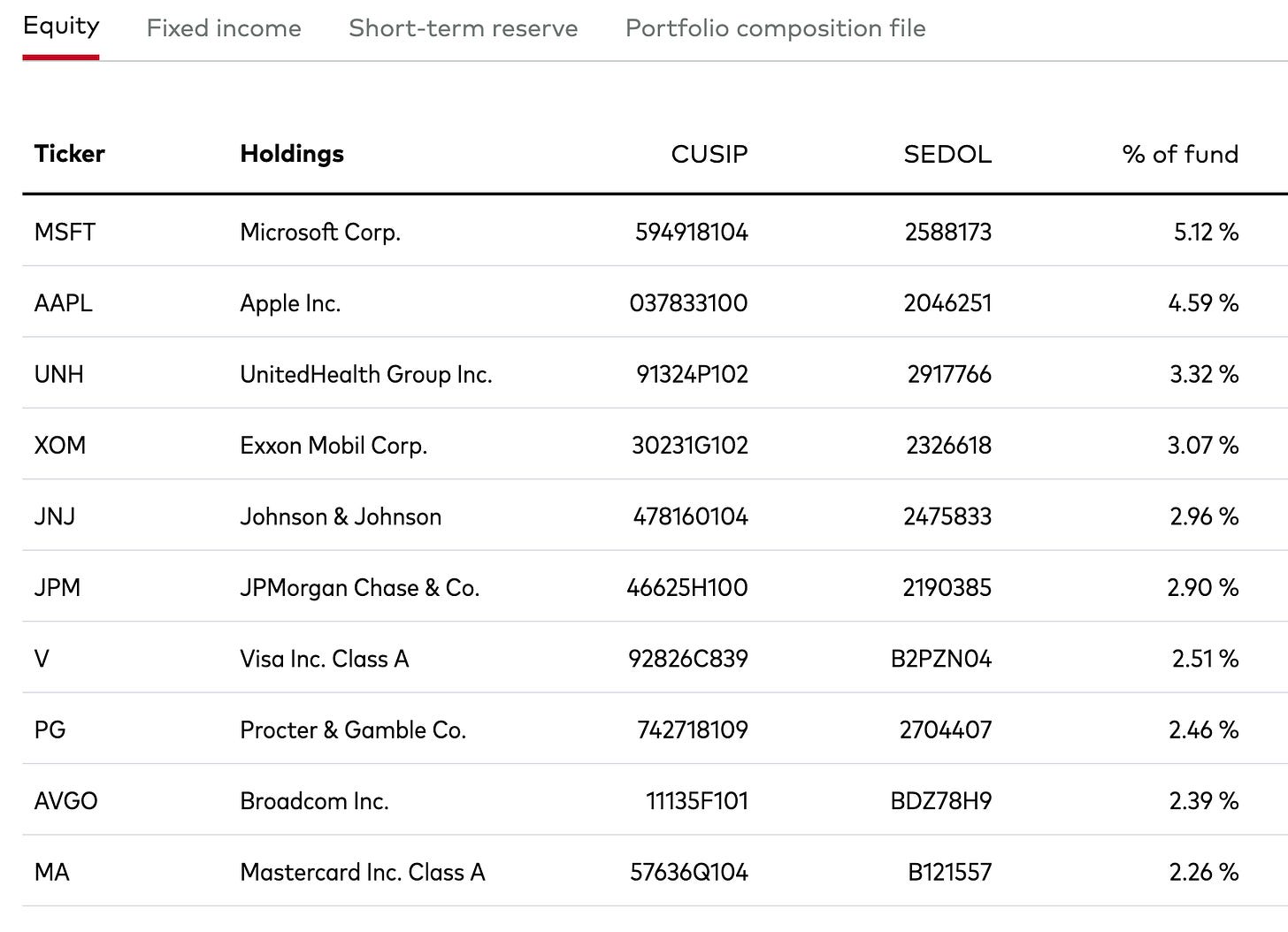

I liked VIG, as it focuses on the dividend growth over the period of 10 years & eliminates top 25% high yield to eliminate companies with financial instabilities. And it’s well diversified with 314 holdings.

Only drawback is the starting yield is low, roughly 1.9%. But dividend growth over the period looks good.

And then I looked at the VYM, and not so inclined on this index as it just looks at the yield alone. Since companies pay high dividends, it doesn’t mean they are good. We need companies which keep increasing dividends in the long term. So I am skipping this ETF.

Then comes SCHD, this one is very interesting. Its starting yield is ~3.5% and asset growth over the decade is also good. And the index methodology is also good, as it focuses on cash flow, debt, return on equity & dividend growth.

Only drawback of this fund is it has only ~100 stocks in the portfolio. It’s less diversified than VIG & has a history of only 10 years. But I like to give a shot on this ETF.

Now that I decided to go with VIG & SCHD, I need to decide on how much to allocate to each. I definitely want to overweight VIG as it's well diversified, and I thought maybe I will go with the allocation based on these ETF’s AUM.

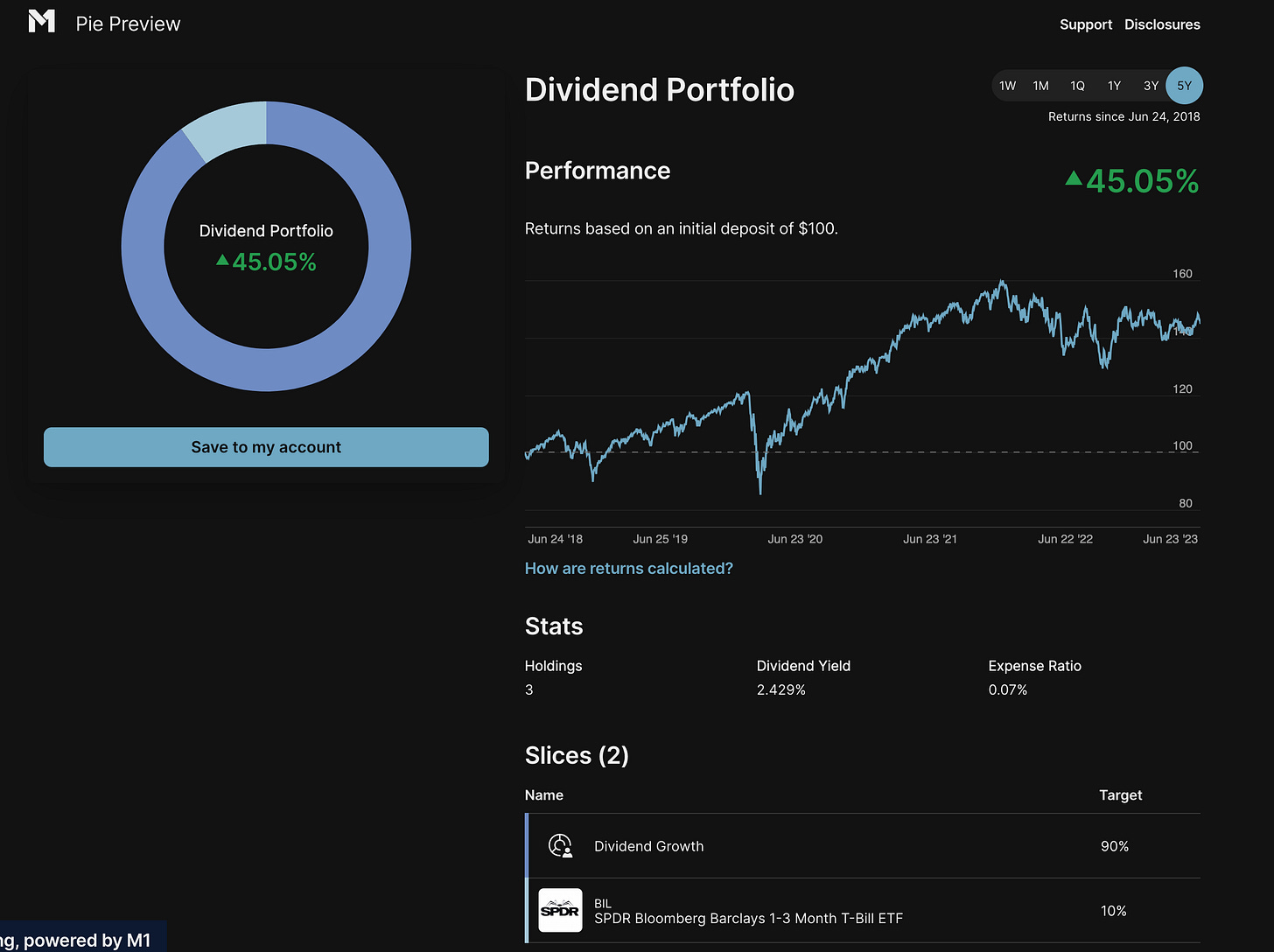

So it comes to roughly VIG - 60% & SCHD - 40% for the equity part of the portfolio, which is 90% of the total portfolio.

Though it’s rare to cut dividends it may happen sometimes, so I like to keep 10% in cash equivalent. I am using BIL ETF for that, a 1-3 month treasury bills which is not susceptible to interest rate risks.

I took this inspiration from Warren Buffet’s portfolio which he created for his wife which is 90% equity & 10% short term bonds.

This’ how my final portfolio looks like. 3 ETFs (VIG, SCHD, BIL), with total expense ratio of 0.07% ($7 per $10,000) & dividend yield of ~2.5%.

You can click around & play with this portfolio here.

Conclusion

Focus on the dividends as it fluctuates way less compared to the stock price and this helps to stay invested rather than panicking.

Only if you buy right, you can hold tight during the downturns. Buying index based ETFs which focuses on quality companies helps to hold tight & ride the wave.

Let me know what you think about this thought process & hit me with your thoughts & suggestions.

Lot to learn in this weeks update! I am a novice to investment, will read up the links you provided.