Sara’s Weekly Update #23

Welcome to my newsletter! I write down my thoughts & opinions on the topics I read/watched last week. My topics of interest are broad, please feel free to skip to the issue you like.

At the G20, Biden joins forces with India and the Middle East, sidelining China

President Biden announced plans for a new rail and shipping corridor that will connect India, the Middle East and Europe — a long-term push to improve the way goods, energy and information moves across borders, that notably does not involve China.

Finally West is doing something to counter China’s Belt & Road initiative. And it’s good for India in the long run.

Leaders from China, the world's second-largest economy, and Russia — a long-time partner of India — opted not to attend.

Xi not attending is not good. Looks like China is alienating itself from the rest of the world.

Also, there are criticisms that G20 nations went soft in criticizing Russia for the war. This is expected as India & Russia have a good relationship & the G20 is happening in India this time.

You’re talented and hardworking in what is the most innovative platform in history: America.

For decades, America has predicted — arrogantly and repeatedly — the imminent fall of a nation. The doomed nation, according to Americans? A: America.

I too have this doubt based on political divisions and Congress's inaction on gun reforms, increased national debt, and immigration reform. The US collapsing is something that worries me sometimes, as we live here & most of my assets are invested in the US.

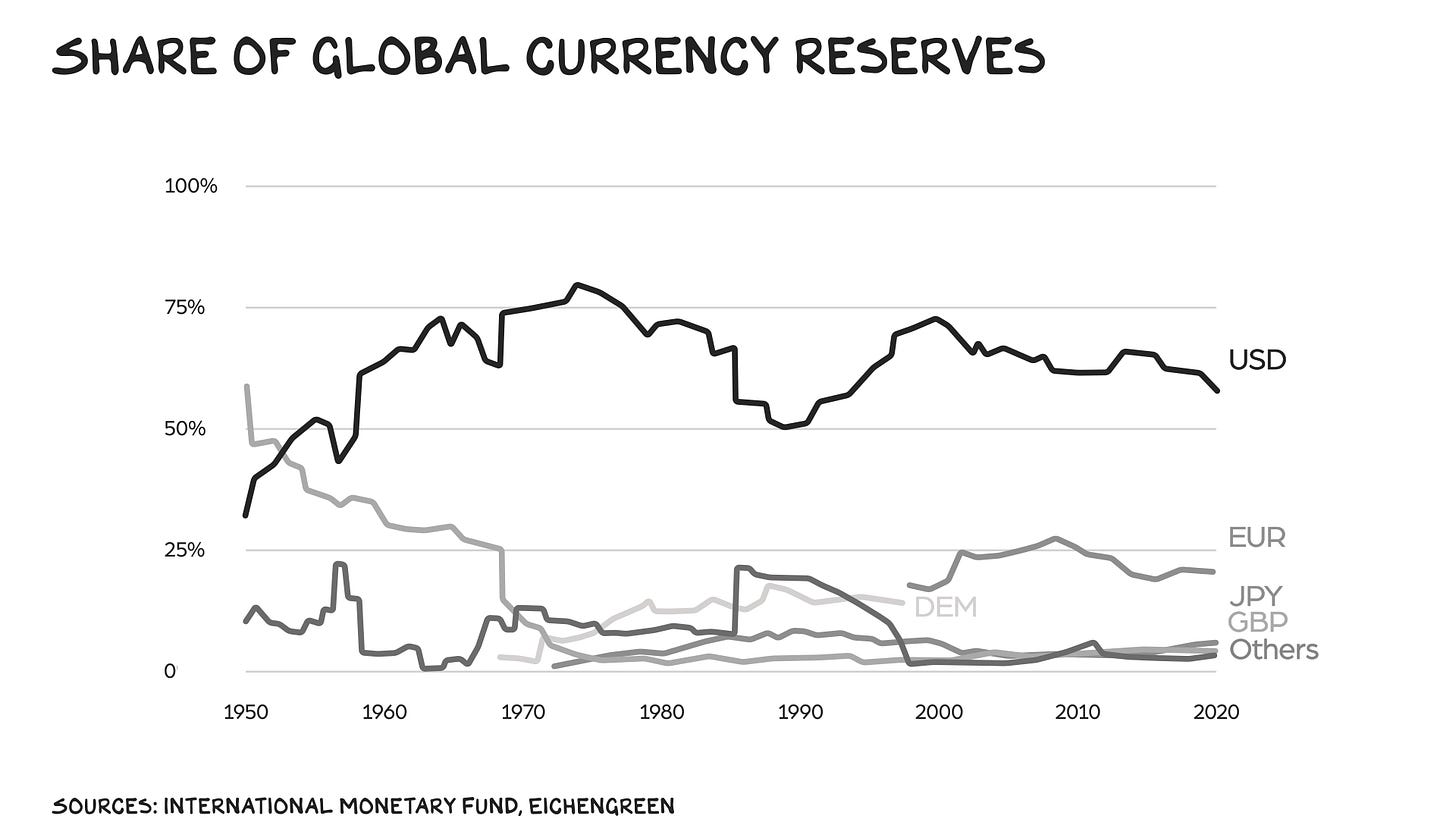

The stat dedollarists point to is that the dollar has fallen from 70% share of the world’s currency reserves to 60% in the past 20 years. That may sound significant, but the scope is comically small. When you zoom out you find that in the ’80s our share was 50%, and 30 years before it was 40%. The only accurate description of the dollar’s reserve status over the past 75 years is … unwaveringly dominant. At 20%, the next-best option (the euro) is not within striking distance.

Another catastrophist go-to: the debt-to-GDP ratio. Currently, our national debt amounts to 120% of our GDP. In other words, we’re borrowing more money than we’re making. Sounds bad. Until you look at other nations and realize it’s, wait for it, less bad. Singapore is at 130%, Italy, at 150%, and Japan, at 260%.

Though this number looks relatively better, it still makes me nervous. I am not an economist but I wouldn't run my home with 120% debt of the annual income.

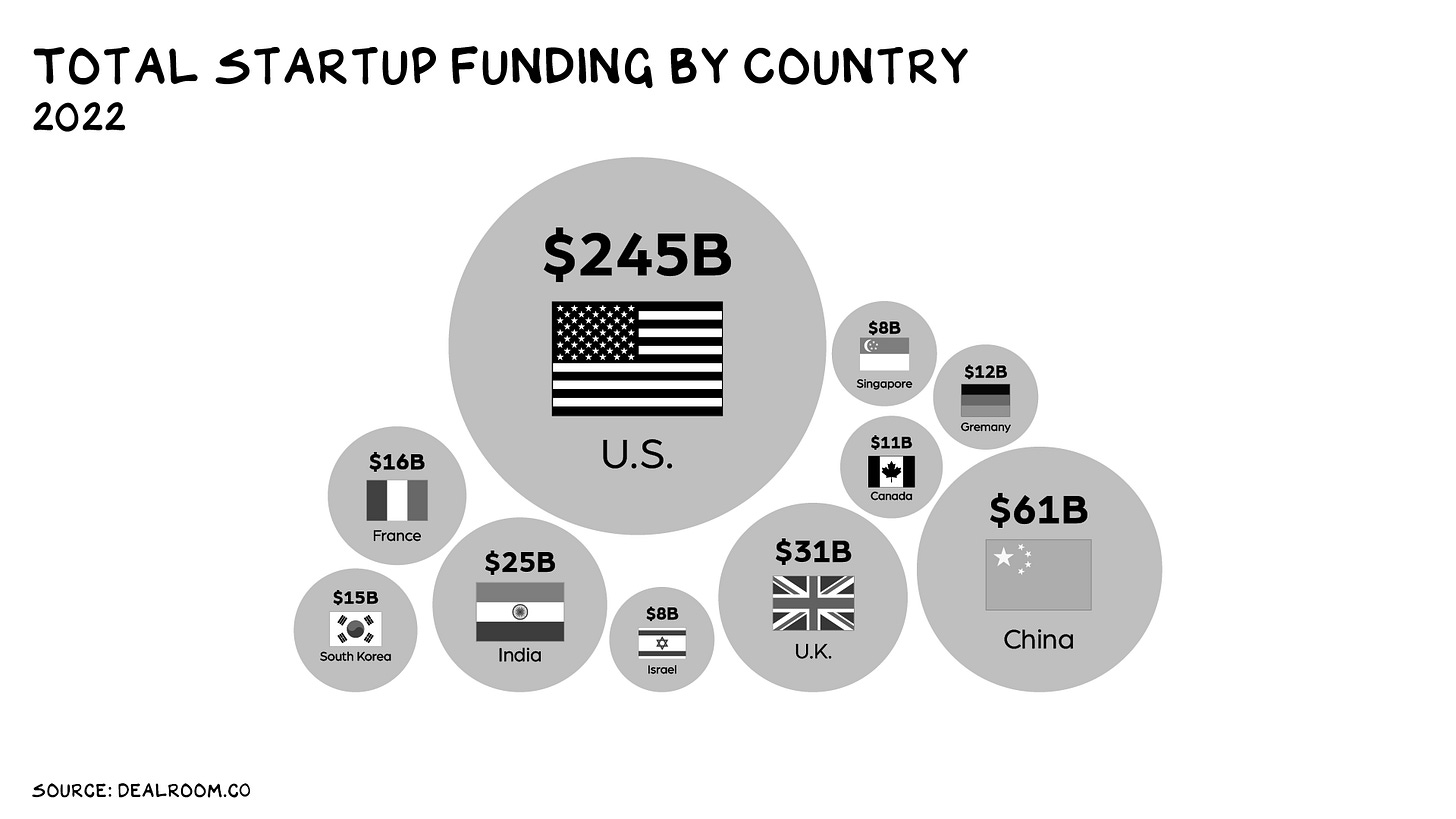

Last year, U.S. startups received $245 billion in venture funding — roughly equal to the rest of the world combined.

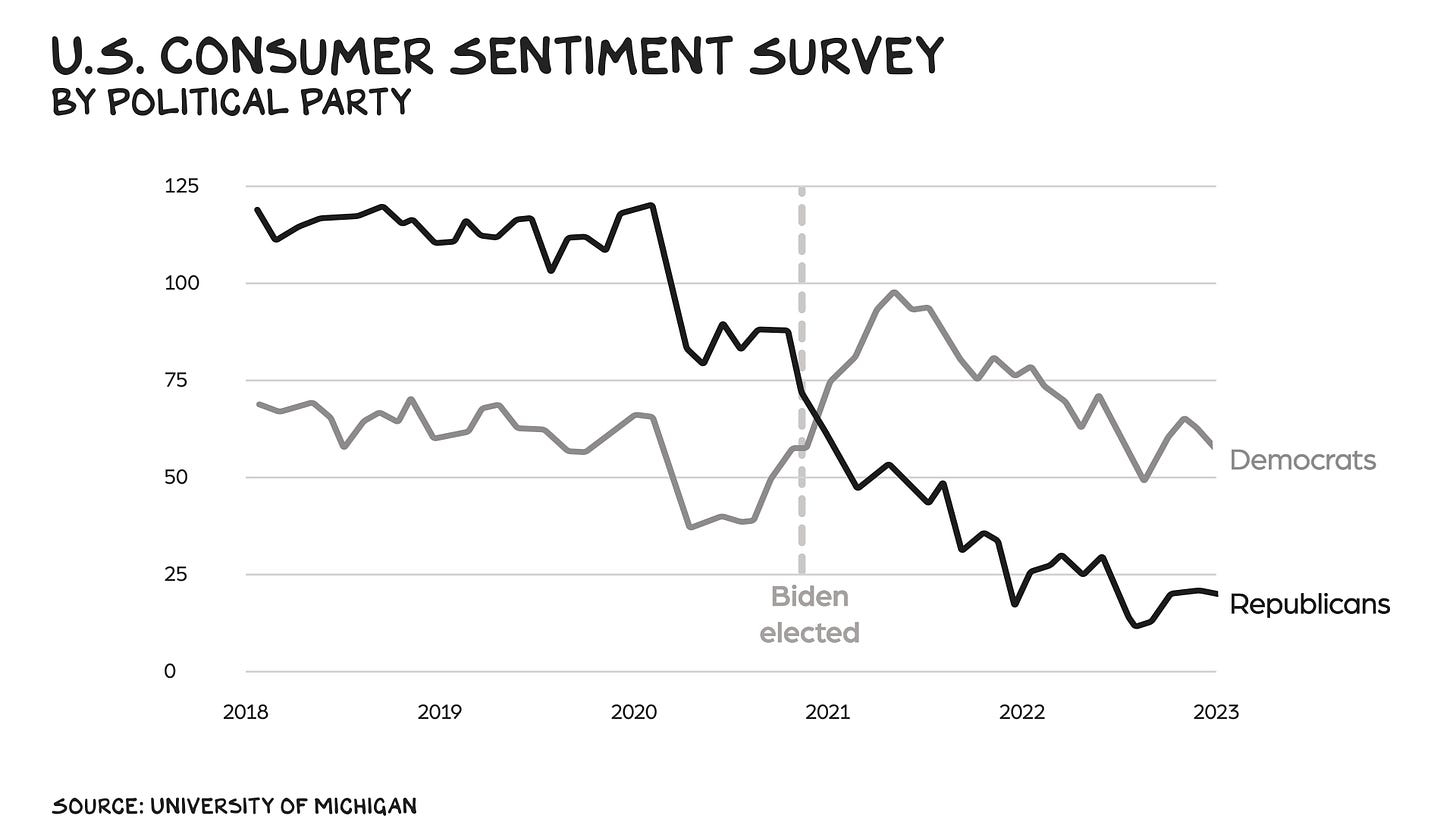

The schadenfreude we feel for our own country when it stumbles is nothing new. In fact, I would argue that in a democracy this is a feature not a bug. Things appear brighter when our favored political party is at the helm, and vice versa when it isn’t.

This is true, the sentiment is low with my right-wing friends.

If you are healthy, have someone who loves you, and enjoy a household income greater than $34,000, then you are in the top 1% globally. Think about this — you are 1 in 100. Why? Yes, you’re talented and hardworking. But more than that, you’re talented and hardworking in what is the most innovative platform in history: America.

Lately, I have a strong conviction that where we position ourselves matters the most. Working hard in a losing country may not help us, but doing the same in a great country like the US propels us further.

Good to see some optimistic articles on the US outlook.

Books:

“The Startup of You” by Reid Hoffman

Chapter 1: Develop a Competitive Advantage

At nearly every point of your career you will have to distinguish yourself from people who share your goals. Put simply, if you want something specific out of life, there are probably others seeking the same thing. For anything desirable, there’s competition: a ticket to a championship game, the arm of an attractive person, admission to a good college, and especially every good professional opportunity. And amid today’s decentralized workforce, your competition has multiplied, because now you aren’t just competing with others who live within commuting distance of your dream job; you’re competing with people all over the world.

This is so true today, same work can be done across the world. The competition is more.

If you want to chart a course that differentiates you from other professionals in the marketplace, the first step is being able to complete the sentence “A company would hire me over other professionals because…” How are you faster, better, or cheaper than other people who want to do what you’re doing in the world? What are you offering that’s hard to come by?

Begin by competing in local contests—local referring to specific industry segments and skill sets. Don’t try to be the greatest marketing executive in the world; try to be the greatest marketing executive of small to midsize companies that compete in the health-care industry. Don’t just try to be the highest-paid hospitality operations person in the world; establish yourself as the best hospitality leader in the ski lodge market. In other words, determine which (smaller) niche allows you to develop a competitive advantage.

Being an expert in a niche area seems like a great idea. This is something I try in my career too, but not there yet.

Before dreaming about the future or making plans, you need to articulate what you already have going for you—as entrepreneurs do. The most brilliant business idea is often the one that builds on the founder’s existing assets in the most brilliant way.

Hard assets are undoubtedly important. But they also have a hard ceiling. There are only so many things you can do for your career with money. And money compounds in an index fund only so fast. With soft assets, on the other hand, the only limits are your own imagination for how to apply them and your appetite for learning. In fact, the right combination of soft assets can 10x your earning power in hard asset terms—and sometimes at lightning speed. So, if you adopt an investing mindset, where do you put your time? Developing hard or soft assets?

Our advice is to go all-in on soft assets. Learn new skills, make new connections, and work on building your brand. Because these soft assets are more difficult to tally than cash in a bank account, people tend to underestimate their value.

In the long run, a person with a foundation of knowledge and skills will make more money and likely live a more meaningful life than the person who optimized too early for a better salary. There’s a similar view in VC-backed startups: Technology companies focus on learning over profitability in the early years to maximize revenue in the later years. So, ask yourself: “Which career options will grow my soft assets the fastest?” Even simpler: “Which offers the most learning potential?”

It’s on you to develop your skills and aspirations in the direction of market demand.

The amazing thing about momentum is that it can make up for a lot of other weaknesses. Some startups deliver a mediocre product developed by a mediocre team (we won’t name names) but they do so in a white-hot market—and achieve great success. The market pulls success out of them. A strong market can overcome almost any deficiency in a startup, at least for a time. This is why we sometimes tell people, “Pick an industry, not a job.” Which is to say, focus on working in a sector that’s hot. Then, once you get to know that industry a bit, pick a company. And from there pick whatever job inside that company is available and roughly in line with your skills and aspirations. Your specific job doesn’t matter nearly as much as the company growth trajectory. Working at a hot company can extend your personal brand and endow you with legitimacy, or just increase the odds of strategic serendipity. And even a modestly impressive company that operates in a hot industry is going to be a source of opportunity.

I strongly agree with this, one of the reasons I joined Nvidia is to be part of the AI wave and it does seem to be helping.

A good career plan accounts for the interplay of the three gears—your assets, your aspirations, and the market realities. The gears need to fit and rotate together.

As Silicon Valley VCs, Ben and I love to invest in internet franchises that possess strong “growth loops.” What the hell is a growth loop? It’s a feature of a business that yields compounding value—value that multiplies over time—rather than one-off gains. Think of a flywheel: The faster you turn it, the faster it spins. Momentum builds and compounds.

Being in a niche area helps to compound the knowledge.

So play with your assets, aspirations, and the market realities until you see compounding potential in one of the combinations. Sure, being faster, better, or cheaper for a given job will make you more competitive. But if you find a growth loop for the intersection of what you do well, what you value, and what the market wants, then you’ve got something even better. You have a rocket-ship career.

Personal Update

I could not write this for the last 4 weeks, My wife was traveling for work and I had to take care of the kids alone. Then I traveled to India for two weeks to attend a close wedding and check up on my parents’ health.

Now I feel like I am back to routine.

Another lovely update Sara. Keep up the good work. I read the startup off you. A good one. Your summary is helping to recall. Thanks!

Thanks for writing & sharing 👍